Are you worried about the future of your small business? Despite growing concerns about an impending recession, there are still steps you can take to recession-proof your business. By planning ahead and implementing strategies that will keep your company afloat during tough times, you can ensure that your business remains strong no matter what the economy throws at it. In this blog post, we'll outline a few key strategies for recession-proofing your small business. Read on to learn more!

The Recession Is All Over The Press.

So, we're hearing a lot of recession discussions from business press such as the Wall Street Journal, Businessweek, and Bloomberg. A few recent headlines we've seen:

- Are We In A Recession? It's Complicated.

- What's Happening in the World Economy: The US is Witnessing a Pre-Recession

- One in Three Chance Of A U.S. Recession

- Recession Or No Recession Is The Question.

There's a lot of recession talk lately and no one really knows where it goes, but the most important thing is to be aware that small businesses are hit the hardest during recessions.

Small Businesses Are Hit Harder By Recessions.

Although both large and small businesses felt the steaming of job losses during the 2007 to 2009 downturn, small business firms experienced disproportionate declines. This note came from a study from the Federal Reserve Of New York out of the last big downturn.

And what came out of that is we saw weaker consumer demand, credit supply, and availability constraints were hurting people along with bankruptcies and companies going out of business and in deterioration in the labor markets.

So let's consider the following:

What do I need to do if we go into a prolonged recession or even a recession at all, and how do I thrive when others are just trying to survive?

Four Strategies to Recession Proof Your Business

So there are four strategies that we'll talk about today to recession-proof your business. They are: manage cash, improve profits, plan for the future, and get ready for rainy days.

#1 Manage Cash

First of all, managing cash. Cash is the lifeblood of your business. Without cash, just like the blood in your body. You can lose some of the blood, but if you lose enough blood you'll die. That's the same thing as your business with cash, you can lose some cash, but if you lose enough that you'll die and cash flow is a vital part of running a business and being able to manage it.

Revenue is vanity, Profit is Sanity, but Cash is King. - Doholis-Lambert

How do you manage cash is the question? The two most common tools that companies use to manage cash are: the statement of cash flows and cash flow projections and a lot of people don't know the difference between the two.

Statement of Cash Flows

First of all, your statement of cash flows shows the changes in your balances. That is the balance in your balance sheet accounts, which are your statement of financial position. So first of all, you look at your net income which is your profitability and you can move that up and down through your revenues and expense management. And we'll cover that in a moment in improving profitability. But then you have your non-cash items that come through.

But most importantly, if you're taking longer to pay customers that improves your cash flow, if you are getting money in quicker from customers that increases your cash flow.

If you pay more out to increase your inventory that reduces your cash.

And then you look at things like operating or investing activities like buying equipment or purchases or software. And then you also have your investing activities where you may be borrowing money, paying money down paying down debt. Those all affect how you're at.

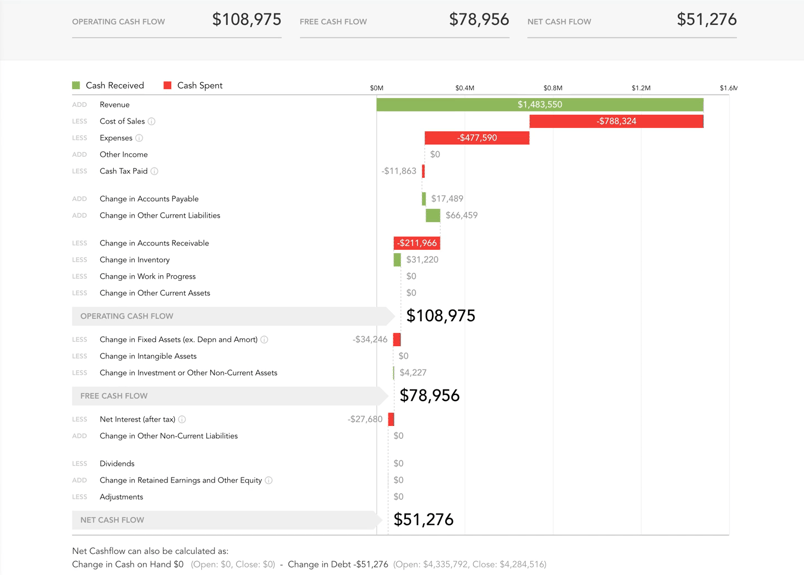

-Cashflow Waterfall Chart Example From Fathom

Here we've got a waterfall that shows red uses of cash and green, where you're gaining cash as well. And this comes from one of the software that we use here at ROARK to help explain cash flow. But don't be confused - The cash flow statement is one of the hardest ways to manage cash, and there's a better way to manage cash.

Cash Flow Projections

And that's through your cash flow projection and in your cash flow projection, you're really gonna find a lot about your business.

Beginning Cash Balance

+Cash Receipts

-Cash Disbursements

= Net Cash Flow

+ or - Line of Credit or Payments

=Ending Cash Balance

Now you may have multiple streams of revenue that come from your different cash receipts. You could have product sales, you could have service contracts. You could. Hourly consulting and these different revenue streams will come in, as cash comes in differently for these things. You could also have deposits as well, maybe customer deposits that come into your total cash receipts.

And so in your 13-week cash flow, which happens to be a quarter, you measure that week by week and you start to get a good feel for where your cash is coming in.

And there is timing differences between your revenue and your cash. Some are more pronounced and some are less pronounced just depending on the business that you are in.

One of the most important things and where I see a lot of aha moments is in your cash disbursements. What are you spending cash on? And how frequently does it happen? Your cash disbursements. A lot of times our payroll, rent, product purchases and we have an example template here that you can use. And if you click on the image below you can download a sample cash projection template that you can use for your business.

Now you're going to have different expenses. You're probably going to have different revenue types, but modify and adapt the template for your revenue streams. This will be helpful for you.

But if you look at your total cash disbursements week over week, and then you'll say, "Hey, Here's my cash coming in. Here's my cash coming out." You really do learn a lot about your business.

And a lot of times, what we see is people will accelerate their cash receipts coming in as they're studying it. And then there's a lot of times expenses, unnecessary expenses is prepped into your cash disbursements. And as you measure it that way and start putting value on that with the cash and trying to get to net cash positive you start realizing where you're spending your money that gives you your net cash.

And then obviously you have your line of credit borrowings that you can either pay down or borrow if you have a line of credit. And we'll talk about establishing a line of credit later, that goes to your ending cash balance, which gets carried over every week into your new cash balance. By understanding these cash flows, it's very helpful for you and being able to manage your cash and understand where your money's going.

And then you can go into some more advanced, some pro tips, maybe that aren't in our typical. You can actually measure it on a four and five week basis and look at your mu monthly cash flow. And you can do some budgets to actuals. I've done some of those things where you're like, oh, this is what we thought we were spending.

This is what we're actually spending that helps you actually modify these cash projections later.

#2 Improve Profits

Now your next thing most important is maximizing profits, right? So managing cash is one thing and that's the timing of things coming in, but the best way to be able to get cash into your business is be profitable and maximize those profits.

Maximize the Profitability of the Business

To maximize the profitability of a business, you've got to understand the key drivers of profitability first and foremost.

Maximize Revenues

When we look at maximizing your revenue we think of three things: revenue design through product innovation, market opportunities, and pricing and volume. Then you can manage your cost, but always start with your revenues first.

Manage Costs

Managing costs goes into improving your margins, whether it's your cost to produce whether you're a service or a product based company, as well as your overhead expenses or your expenses that you can manage.

Measure What Matters

And then what's really important is measure what matters, make sure you have good KPIs and key analysis. And we'll go into this in just a moment.

General Rules for Maximizing Profits During a Recession

So first of all, let's start with some general rules. When looking how to increase revenue, start from a positive state of mind. One of the things that I would suggest to everybody look at is and Jim Collins who was famous for the Stockdale paradox. I'd suggest Googling Jim Collins and how

General Stockdale made it through the hardest of times. But start with increasing revenue. We always wanna start on the positive.

And then the second general rule is it's very difficult to cut your way to profitability unless your expenses are completely out of control. That is tough. Now there is right sizing, especially in a recession, whenever maybe sales aren't as strong.

But to cut your way to profit - It's a very difficult thing to do. You gotta make sure you're starting with revenue. And that goes into our final general rule: be careful about cutting sales and marketing costs. During the downturn, especially marketing people are very tempted to do that. and it's tough because the amount of expenses you have to cut as compared to the amount of sales that you may lose may be very difficult.

Maximize Revenue with Revenue Design

So you just gotta be very careful in looking at it. First of all, we talked about maximizing your revenue with your revenue design. You wanna look at your revenue design, especially going into a recession. So are all your revenues, are they recurring? Are they one time transactions? If you have recurring revenue?

It's so much easier with recurring revenue because you have that revenue that you can count on each month and unless you're losing clients, then that revenue stream stays very consistent. If you're doing one-time transactional type of items where there's less relationship, it becomes more and more difficult because you've got to continue to do that.

And companies are looking to cut so transactions and things like that, that aren't mission critical are areas where your customers are gonna look to cut first. So having those relationships and that, that revenue stream for you. But what your customers count on for service is very helpful in recession proof in your business.

Then the other thing is you wanna look at. Your product offerings. So a lot of this hopefully is done before you get into the recession, but what products work well in growth and what products work well in decline or in recession? And if you don't have a product that works well in recession and you're in a recession, guess what?

Now's a great time for you and your management team to show your grit and determination, to be able to develop that product. And so they say necessity is the mother of all in mentioned. Maybe now's the time to have the mother of all in mention and look at it this way, guys, recessions, aren't all bad.

And this is something that we learned through the business here at ROARK- they create market opportunities, right? So like when Gretsky said skate where the puck is going to be. If you are looking at the recession, you understand the trends that are happening in the market. You can get in front of those trends and really seize the market opportunity or market share as your competitors are making changes.

Have Your Marketing Bullhorn Ready

And that brings us to our next point, make sure that you have your marketing Bullhorn ready to seize those opportunities, right? There are great opportunities during the recession, and you may even wanna alter your positioning to take advantage of those opportunities. Another tip is to look at bundling products and services together, to be able to create more value for customers and to be able to upsell and grow your business.

You may want to diversify your spending to take advantage of products with the greatest opportunity. So we've done analysis before on margin, and it's amazing how companies don't always realize what are the most profitable products. And what they deliver. So it's time to go look at those things and really spin your marketing dollars towards those things that are strong.

These recessions are great times to do a reset as you're growing and make sure that you're always keeping in mind the positive you can grow your market share and build customer loyalty. Everybody's struggling during this time, including your competitors, including your customers, what are you going to do to stand out?

And we look at this at ROARK and we said this during our last great downturn was, Hey, you know what? We solve problems. This is what we do for a living, there are a lot of people with problems, and even if we can't go do it, go solve people's problems. And that was just the way it's just going on to.

Pricing and Volume Changes to Maximize Revenue

Next, you're going to want to look at pricing and volume changes to maximize your revenue, right? So if you look at price increases and we've experienced a highly inflationary economy more recently but price increases go straight to the bottom line. And I would say don't delay. We see too many companies that are afraid to broach the price increase.

And then what they're doing is they're waving waiting, and they're waiting to bust. And then it has to be a big price. If you're doing those big I price increases, then you're gonna push your customers to shop other people in other places. If you do smaller, more frequent price increases, you're gonna see that works better.

And that's gonna tie a lot better to commodities or labor just depending on what the big driver of your business is, but we find that's easier digestible for clients. And having that open communication and talking with your customers will win you. Also, make sure you're understanding the relationship between volume and price.

So as we talked about potentially raising prices which is great, if you can raise prices more than the decline will take, then you're ahead. If on the other hand, you raise prices so much your demand lowers, then that actually becomes defeating, but a way to look at that also, and be able to measure that is making sure you're thinking about promotions, things that are gonna be able to help clients, especially during difficult times.

They'll remember.

Reduce Costs to Produce Goods & Services

Now, if you're going into your next area and you're one of your most expensive areas, typically your cost to produce products or deliver services. So now's a good time during the recession, make sure that you're right. Sizing volumes. A lot of times when things are going well, we keep focusing on the growth, but now's the time to go back and look at those.

And even renegotiate costs with vendors, everybody, with a declining market and sales people are always looking to be able to capture market share, and there's more capacity. Make sure you're looking at those, taking that time to go back and maybe renegotiate and make sure you're rightsizing your volumes or your purchases.

Also, employees are typically your most expensive line item. Second to the direct cost of being able to produce or deliver services deliver service model. If you're professional services, then obviously that's gonna be labor, but now's a great time to go back and revisit who are the, A, B and C players on your team, especially with the tight labor markets that we've had.

It's time to start shedding the C players. It's time to evaluate the B players, but make sure we're maintaining the, A players. And if you're holding on to B and C players, that's not an environment, typically A players want to be in. But then also, I would say, be on the hunt for those A players because downturns breed instability and companies struggle.

So there may be A players out there during this downturn where you can actually make a positive impact for your organization.

The way of the future is to automate, and we always say automate and eliminate. So now's the time to go back and look and say, Hey, what are ways and jobs that I can automate things that I can do to improve processes and streamline, to gain efficiencies?

Reduce Expenses to Improve Profitability

It's a great time to reevaluate that, especially as you're going through this downturn, and then next you're gonna wanna look at your next line items down, which is your SG&A area. And you're going to want to look at reducing expenses to improve profitability. So overspending gets mass whenever good times are there.

So it gets hidden. So it's time to go through each one of these P L line items and say, Hey. What do we need? What don't we need, what's really working? And what is providing this value also a good way to do this is implementing zero-based budgeting. And we'll talk a little bit more about the zero-based budget in a moment, but it's basically starting with a clean sheet of paper and saying, where are revenues are gonna be?

Where are our expenses? And then comparing that to what you have. A lot of times you'll go, gosh, there's some fat in here that we can cut. This really isn't as valuable as what we do. And then make sure that you're reviewing the investments that you're making in the future of the company. So R&D expenses and things like that, kinda like sales and marketing.

You want to be careful in cutting these expenses, but the time to invest is when times are going good. If times are going bad, you're gonna want to conserve cash so that you can make it through it's about survival mode during this time survival and then thriving. So some of those areas where you're investing may be in new employees and things like that, we talked about.

Measure What Matters

So most important is keeping your pulse on the business. And the best way to do that is to measure what matters KPIs. Scorecards are gonna be critical to be able to keep you on track. And you're gonna wanna measure those weekly monthly, quarterly, and annually, but especially on your KPIs and scorecards, you really want the pulse and that weekly score card is gonna be the way helping you manage the business.

You're gonna wanna look at things like not only P&L items like Profitability. Make sure you're looking at financial performance as well as financial position to the balance. You're gonna wanna look at the department performance and make sure you're looking at employee performance too. And with our firm, we look at what we call the big three, which are the three most important things to do the job and the measures for those.

So make sure you're looking at those. I highly recommend using a red, yellow, and green system in your dashboards and your scorecards. Then you can easily see the areas that are on-track, off-track, and be able to address them. And then just a couple of key things that you may wanna look at and there are several different types of scorecards or software that create scorecards for you.

Manage by Numbers Using Key Calculations

Use common business ratios and things like that to look at these numbers. A few important ones are break-even point. And you can Google, the "formula break-even point" - it's really fixed cost divided by one minus variable cost. And then looking at that as compared to your revenue drivers.

Cost of customer acquisition is critical. Just understanding how your sales and marketing efforts are going to change to reduce the cost of customer acquisition and then compared to customer lifetime value, just to make sure your sales and marketing are doing what you need them to do.

And then one thing that a lot of our business owners look at, especially small businesses, is revenue per employee. That gives them a good time of when they need to scale up or potentially scale down from an employee perspective.

#3 Plan for the Future

Our third pillar is planning for the future. Obviously, there's a lot of change that is going on during this time of recession. So now's the time to make sure you're planning.

Accounting = History, Finance = Future

And one thing that we see, especially small businesses doing is accounting. So accounting is really history. What happened in the past? So it's what already happened.

But you don't want to just look at what happened. You wanna look at what's going to happen, especially as things are changing so that you can get in front of it and make the necessary adaptations and changes. This is called finance - it's forward-looking.

So your financial statements of your income statement, your balance sheet, your statement of cash flows, that's all that happened - Accounting.

Create budgets and forecasts to look ahead.

Your budgets, your projections, your rolling forecast, your scenario planning. Those are all things that will happen or you expect to happen so you can make better-informed decisions. So when you're looking at creating budgets and forecasts you can set them annually, quarterly, and monthly. This is using finance to help you run your business better.

Again, with your KPIs. You want to set those weekly and have your targets weekly for your KPIs and scorecard. But look forward, you look at your monthly, quarterly, and annually.

Things change quickly. Update your plans and projections.

Your annual projections and I really am a big believer in rolling projections because things change, especially in the world of business today.

So make sure that you have a system and a way to be able to update those. And also make sure that you're reviewing these regularly against your actual, that way you can better project what better project and budget what's going on in the future. So the first time that you do this, it's a little bit tougher, but as you start doing it is you start looking at actuals.

You'll really get into tune and in touch with your business and in sync with your numbers.

Use scenario analysis modeling to set strategies to achieve goals.

Scenario analysis really important. So you wanna look at changes. Like we talked about a little bit earlier, increases in price. What does that do and how does that change volume? Let's run that scenario and see how that puts us further ahead or does it take it backwards?

If we make this change in, reducing credit terms for our customers or paying out our vendors, now, all those things sound great. but if your customers and vendors don't want to do that, then that becomes a challenge you're gonna wanna look at, Hey, do I make these investments now on R & D and fixed assets and things like that as well.

So make sure you're doing your scenario analysis, put that into your projections. So that way you can see the results of what you're assuming or your assumptions in making these significant changes to yours. Now, it's a lot of work, especially if you're doing it the old-fashioned way, which yes, the old-fashioned way is no longer green sheets but Excel.

Great Tools Recommended for Small Businesses:

But there are some great tools out there to be able to help you.

ERP Systems

If you're not invested in good ERP system, a good ERP is very helpful, especially for small businesses, you got companies like NetSuite, Sage, and QuickBooks that are all very helpful.

Expense and Cash Management Tools

And then you have like expense management tools and cash management. Bill.com is great because they do ACHs. So if you can put your customers on ACHs that's helpful. It also automates the AP process and speeds that up.

Forecasting where you're going with expense management, Divvy that's a great tool, especially for sales people. You can control your corporate cards, set a budget, so you may want to tie those, ramp those back or move 'em forward.

Forecasting Tools

And then a lot of this forecasting stuff is a lot of work, so there are tools out there and there's several apply like Fathom. They're all at different price points and they work with different systems, but those are gonna help, the basis of your decisions. And I've heard some people say, Hey, these tools are really expensive.

These tools are really expensive not to have because being able to set a direction, even if it's just one FTE say that you changed or a 1% reduction in your cost of sales that pays for these tools for years to come.

#4 Get Ready for Rainy Days

So now you're going to want to make sure to get ready for the rainy days with recessions, there are rainy days ahead, and the best way to do that is to make sure that you're saving for a rainy day.

Do you have a rainy-day savings fund for your business?

Set up a separate savings account. If you don't already have one, get one then have a plan to save. What dollars am I going to save per month? What am I gonna do? A percentage of sales or revenue? Whether you set it on a regular basis, a periodic basis, or you do some kind of automatic thing, that way you're saving for a rainy day. The one thing I can guarantee you in business, there's gonna be ups, there's gonna be downs.

And so make sure that you have it all around and set a target for your cash reserves. So a lot of businesses will set three to six months of expenses for cash reserves operating expenses. We're believers in saving for a full year. That's not always as, as easy for people to do. But I think it is the best practice

And you might say, what? Pardon me.

A Year of cash reserves is very important because then you can take advantage of market opportunities. Remember how we said earlier that some of the, A players may be looking that will give you fuel to attract some of those, A players and be able to potentially take market share, or offer some discounts or, be able to invest in things that are really gonna help you, including maybe doing acquisitions during this time.

Build Important Relationships Now

Because there are a lot of businesses that are struggling out there so make sure you're considering both debt and equity financing. And one of the things that's really important. And the thing that I find very ironic investors and lenders tend to want to lend money when times are good. The thing is you need it when times are bad.

So the key is to make sure that you're building those relationships. Today character is key and especially the more that the lenders know about your business, especially with banks and financial institutions, they're gonna be more apt to lend your business. And that's one of the important things.

And I've talked to several bankers. We have a lot of great bankers that we work with and that's always on their checklist. Character does count understanding your business does count, and that is important along with the financial performance. You're gonna also want to look at maybe multiple bankers. So if you have maybe a very conservative banker, like the big banks, you may want to develop a backup banker that might be more aggressive or may, have more flexibility for your business.

So consider doing that, especially as recession looms, if you want to meet great bankers, we know a lot of great bankers, please reach out to us. We're happy to make introductions for you. And then, like we said, having good financial information, having it ready, having the relationship and then them getting to know. So to recap - bankers w

Important Financial Information Bankers Want and Use

Some of the most important things for a business to have are ready for raising money. And there is a plethora of ways that you can lend and borrow money from lines of credit, to credit cards, to factoring, to mezzanine debt. There's just a whole big gamut, but today we're gonna focus on small businesses.

You're really gonna wanna make sure that you're focusing on profitability. Something's funny about bankers and lenders. They wanna get paid back so they want to understand how you're going to pay them back. They want to see that you have positive equity or net worth. A lot of times that's intangible net worth. If you have, intellectual property or intangible property.

Also, a good rule of thumb for small businesses is they tend to lend 10% of revenues.

So if you're looking for some kind of financing, 10% of revenue is a great number for small businesses as we go to the middle market.

Some of these dynamics and lending relationships tend to change and owners must be willing, and some banks/lenders will be expecting personal guarantees for the owners or significant owners in the organization. So especially if you're a small business, they're going to want to have multiple ways to be able to get repaid.

If you're looking at doing equity financing, it's really important to have a pitch deck and a pitch book. That does take some time to develop because you're going through every area of your business. It is a true business plan. It's a great thing to have just to go through, to even understand your business. So I'd suggest if you're looking at bringing on equity, make sure you have your pitch book ready up to date and refined. You can dust that thing off in a year or two and your business will change and evolve hopefully as you're grown.

Let's recap the four strategies to recession-proof your business.

So let's go back to the major four pillars of recession proof in your business. They are managing cash, improving profits, make sure you're planning for the future and get ready for a rainy day.

If your small business needs to improve it's usage of finance and accounting to take control of your business, we'd love to talk to you about outsourced finance and accounting. We can help you put these practices in place. Contact us to learn more.

Again, we want your business to be ready to thrive during any type of recession. We're here to help. And again, don't forget to download our 13-week rolling cash flow projection template - we think it will be a big help in managing your cash.